At Joti Financial we find that a lot of our clients can be a little nervous seeing us for the first time, because they are not sure what to expect and often the only experience, they have of talking about their finances is with their bank. We want our clients to feel at home with us, so we would like to share with you our process so you know exactly what to expect.

Which is for any client who comes to see us for the first time whether they are buying their first home, next home, an investment property or refinancing.

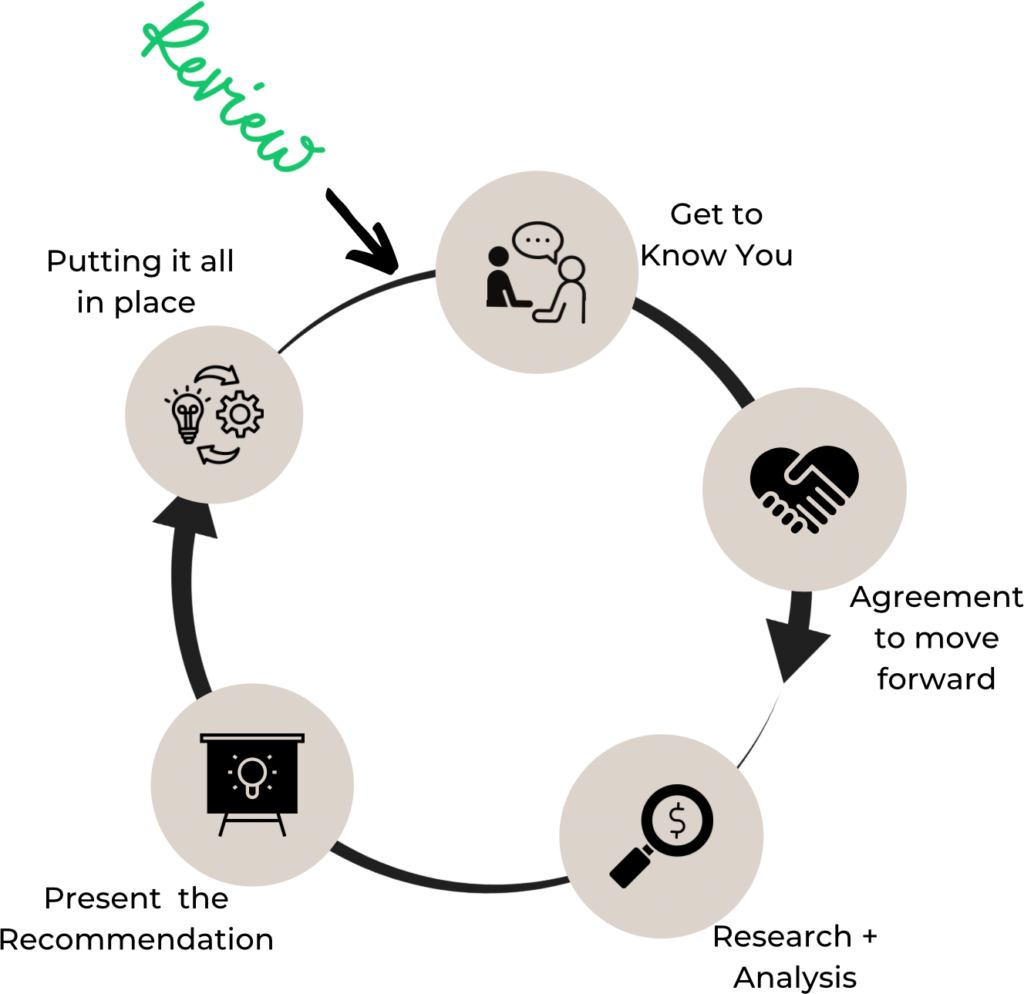

Which we offer our existing clients where we will sit down with you and review your current loan and circumstances to make sure you still have the right product for you, and if so, we will.

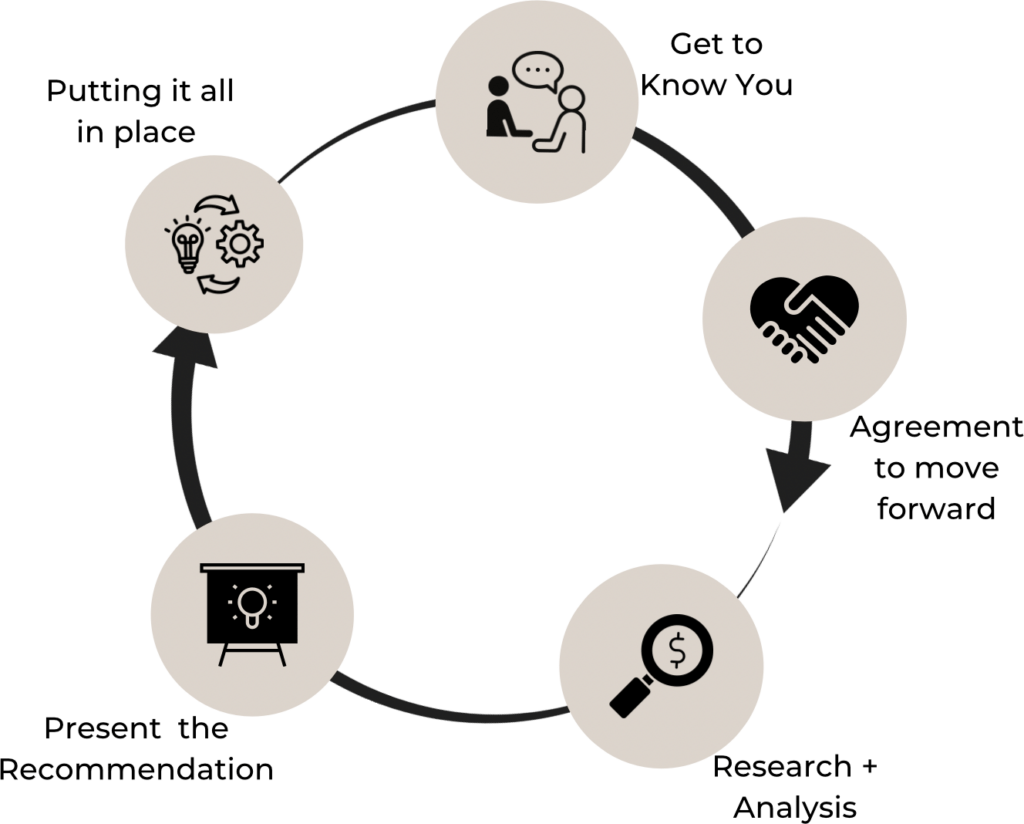

As a client who comes to see us for the first time, our first meeting is all about us getting to know each other and we will take you through our 5 step process on how we help our clients, so you can get a clear picture of what to expect.

You will often hear us say that we offer our services for life – that’s because of the way that we look at our advice process as being a continuous circle, rather than a transaction.

At Joti Financial each year, we sit down with our clients around the anniversary of their home loan to chat about your circumstances again and revisit whether the loan is still the right fit for you…and

One thing that our clients are often surprised at is that our services for our clients are completely free, whether you decide to utilize our services or not.

If you do, however, decide to use our services, the way that we are remunerated is by the banks, who will pay us a commission for placing your loan with them. This doesn’t mean you pay more for your home loan, in fact, sometimes we can get you a more competitive rate than if you went directly to the bank. And as part of our “just one thing” that we are doing for the community, we will gift $100 from the commission we receive from your mortgage to one of the amazing charities that we work with, and you get to choose which one to donate to.

Whether you’re buying your next family home, or an investment property, Joti Financial can help you navigate the home loan market to find a competitive home loan that is right for you.

When I speak with my clients who are buying their first home about the challenges they faced before coming to see us, it is often the same problems that come up each time.

At Joti Financial, we believe our job, is to make your life easier when it comes to home finance whether your buying a new property or refinancing, we are here to help you through every step of the process.

Whether you’re buying your next family home, or an investment property, Joti Financial can help you navigate the home loan market to find a competitive home loan that is right for you.

Anyone who has bought a home before knows it can be stressful, you need to navigate open houses, talk with real estate agents and what most of our clients find the most stressful part of buying a home -looking for finance for their home.

Whilst we can’t help you find a home or talk to the real estate agents; we can help you with your finance for your home and hopefully make the process a little less stressful.

Whenever I’m asked by a client when is the best time to see a mortgage broker, my answer is “as soon as you are thinking of buying a home”. At Joti Financial, we will help you understand how much you will need for a deposit, but more than that, we will help you understand all the fees and charges involved in buying a home so we can work out how much you may need to borrow. We’ll also estimate how much you can borrow based on your circumstances.

And when you’re ready we’ll keep working to make things as easy as possible for you when applying for your loan.

We will also talk to you about our ongoing annual review service, which we offer to all of our clients, so that we continually touch base to make sure that your home loan remains competitive and the right fit for you.

If you have any questions about buying your next home, or an investment property, please contact us, we are here to help and happy to chat to you about any questions you may have.

You can use our online booking system to book an initial chat at a time that suits you, or send us a query via our Contact Us page or simply give us a call on 0488 365 975.

When I speak with my clients who are buying their first home about the challenges they faced before coming to see us, it is often the same problems that come up each time.

Which is where we aim to help.

Whenever I’m asked by a client when is the best time to see a mortgage broker, my answer is “as soon as you are thinking of buying a home”. At joti Financial, we will help you understand how much you will actually need for a deposit, but more than that, we will help you understand all the fees and charges involved in buying a home and what schemes that might be available to help you on your way to buying your first home sooner. And if that number doesn’t match what you have right now, that’s ok, because we will work with you until you are ready. You would be surprised at the difference of understanding these facts, can make it easier to achieve your dream of owning your home.

We don’t stop there though – every client we see, we want them to walk out with more knowledge about home buying and loans than when they came in – so we will walk you through the home buying process, and explain what the jargon means. And when you are ready, we’ll be with you throughout the journey of buying your first home, from finding the right home loan, to general advice around how to make an offer and all the way to you moving in and beyond.

And we’ll keep checking in on you to make sure everything is working and that the loan is still competitive and the right fit for you.

And one of the things that often surprises our clients the most, is that our services at Joti Financial are free . Want to know more, why not request a phone call or if you would prefer to dive straight in, you can make an appointment here through our online booking system.

When refinancing, the main hurdles that come up time and time again for our clients are that:

At Joti Financial, we believe our job, is to make your life easier when it comes to home finance whether your buying a new property or refinancing, we are here to help you through every step of the process.

We all know this feeling – there is just never enough time in the day especially when it comes to having to devote time to something as important as your home loan.

Which is where we can help. As part of our service, we will do the hard work for you – researching the lenders on our panel to find a competitive rate that suits your needs. We will then present you with a recommendation for a lender and product that we believe best suit your needs, which can save you hours of work reviewing the various lenders and comparison sites out there.

We live in an incredible time, where information is available anytime, anywhere. However, there is a lot of information out there and sometimes it can be confusing to understand if the lender you are looking at is right for you, or if they are the most competitive on the market at the moment.

Our job is to help you as much as we can and provide you with information so you can make an informed decision. You will often here us saying that we want you to walk out of our office knowing more than you did when you came in -and we mean it!

We will gather all of the information needed for your application and prepare your application for you and liaise with the banks throughout the application process. We will also continue working with the banks and conveyancers all the way through to settlement, taking away the stress from you all the way to the end.

We will also talk to you about our ongoing annual review service, which we offer to all of our clients, so that we continually touch base to make sure that your home loan remains competitive and the right fit for you.

You can use our online booking system to book an initial chat at a time that suits you, or send us a query via our Contact Us page or simply give us a call on 0488 365 975.

We pay our respects to the Wadawurrung people, the Traditional Owners of the land on which we work and live to their Elders past, present and emerging. We also acknowledge and celebrate the diversity and resilience of the Aboriginal and Torres Strait Islander peoples who have shaped this region.

Joti Financial Pty Ltd ABN 71 665 343 448 is an authorised Representative of Astute Financial Management Pty Ltd | ABN 59 093 587 010 | Australian Credit Licence Number 364253